Business Insurance in and around Fort Madison

One of Fort Madison’s top choices for small business insurance.

No funny business here

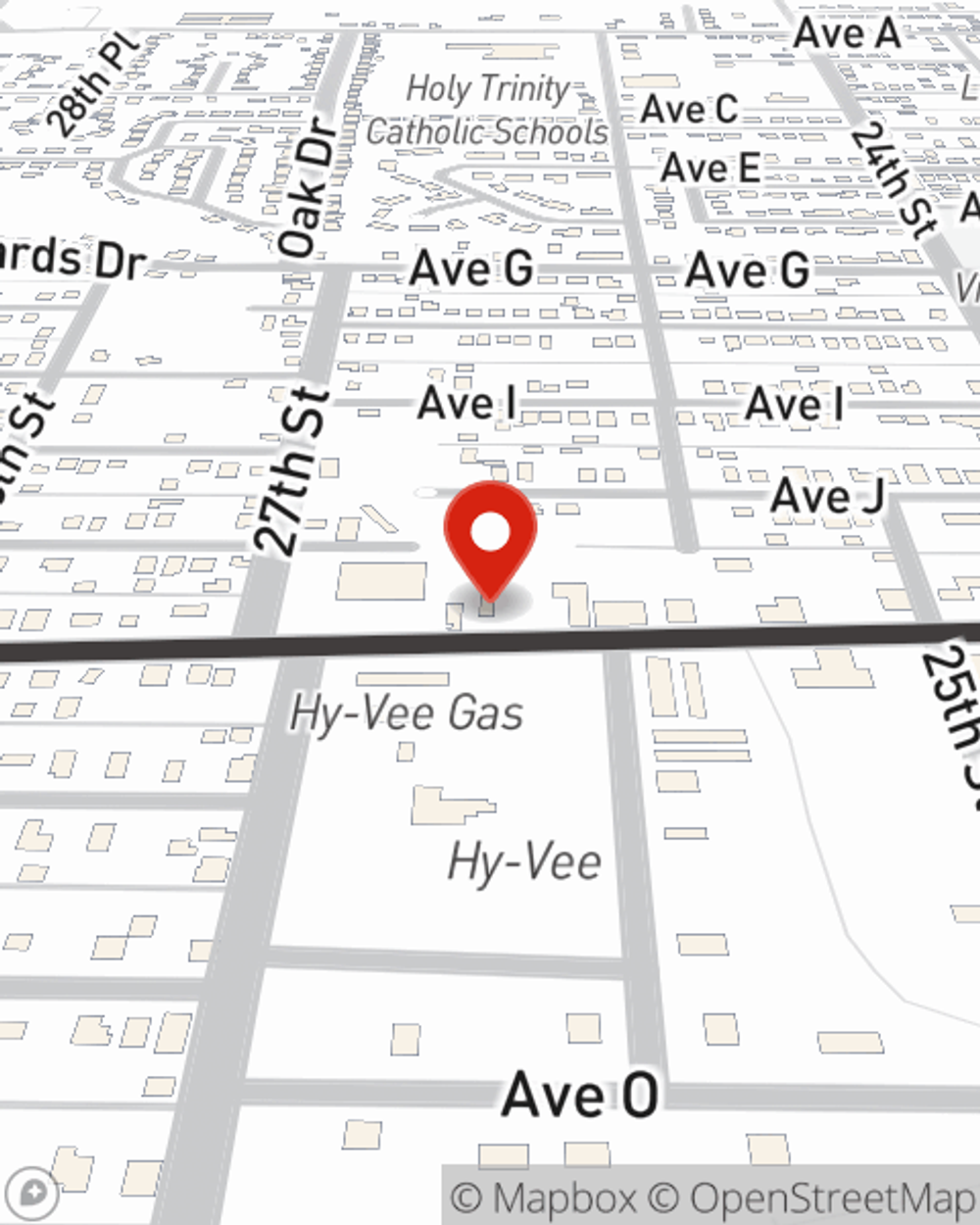

- Fort Madison, IA

- Niota IL

- Nauvoo, IL

- Kahoka, MO

- Lee County IA

- Van Buren County IA

- Hancock County IL

- Iowa

- Illinois

- Missouri

- SE Iowa

- Des Moines County IA

- Bonaparte IA

- Wever IA

- Hamilton IL

- Keokuk IA

Insure The Business You've Built.

Preparation is key for when a problem happens on your business's property like a customer slipping and falling.

One of Fort Madison’s top choices for small business insurance.

No funny business here

Protect Your Business With State Farm

No one knows what tomorrow will bring—especially in the business world. Since even your most detailed plans can't predict consumer demand or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your future with coverage like errors and omissions liability and business continuity plans. Fantastic coverage like this is why Fort Madison business owners choose State Farm insurance. State Farm agent Jess Sutcliffe can help design a policy for the level of coverage you have in mind. If troubles find you, Jess Sutcliffe can be there to help you file your claim and help your business life go right again.

Don’t let worries about your business keep you up at night! Reach out to State Farm agent Jess Sutcliffe today, and learn more about how you can benefit from State Farm small business insurance.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Jess Sutcliffe

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".